does texas have state inheritance tax

There is a 40 percent federal tax however on estates over 534 million in value. However in Texas there is no such thing as an inheritance tax or a gift tax.

Texas Inheritance Laws What You Should Know Smartasset

There is no inheritance tax in Texas.

. There is a 40 percent federal tax however on estates over 534 million in value. But there is a federal gift tax that people in Texas have to pay. Estate Tax in Texas.

The tax is determined separately for each beneficiary who is then responsible for paying any inheritance taxes. Does Texas Have an Inheritance Tax. There is a 40 percent federal tax.

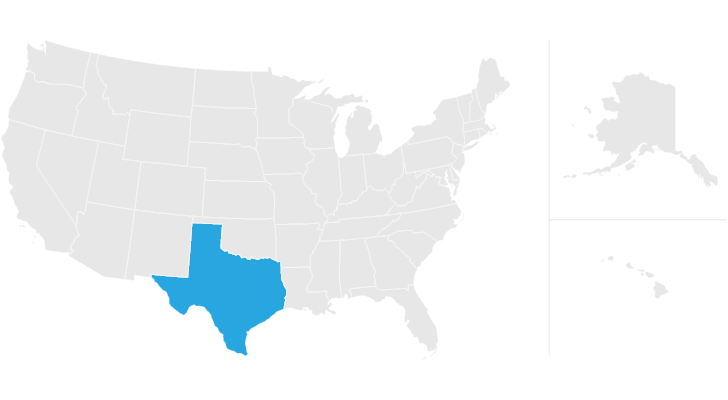

Texas repealed its inheritance tax law in 2015 but other tricky rules can apply depending on what you do with the money or property. While most states in the United States have an inheritance tax Texas doesnt. The state of Texas does not have any inheritance of estate taxes.

Definition of Estate Tax. Impose estate taxes and six impose inheritance taxes. Washington states 20 percent rate is the highest estate tax rate in the nation.

This is because the amount is taxed on the individuals final tax return. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. However texas residents still must adhere to federal estate tax guidelines.

In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. An estate tax is similar to an inheritance tax in that both are imposed on the assets from the decedents estate. There is a 40 percent federal tax however on estates over 534 million in value.

Texas is one of a handful of states that does not have an inheritance tax. Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive. Fortunately Texas Is One Of The 33 States That Does Not Have An Inheritance Tax.

Even though no state inheritance taxes are imposed some estates are subject to federal estate taxes. Therefore if you inherit possessions property to sell or keep or money from a loved one in Texas you most likely wont need to pay any tax. Fourteen states and the District of Columbia impose an estate tax while six states have an inheritance tax.

Right now there are 6 states that have an inheritance tax. In addition to the federal estate tax of 40 percent some states impose an additional estate or inheritance tax. This rate has not changed in 2022.

Iowa Kentucky Nebraska New Jersey Maryland and Pennsylvania. Your estate may be subject to the federal estate tax While there is no state inheritance tax in Texas your estate may be subject to the federal estate tax. Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government.

However a Texan resident who inherits a property from a state that does have such tax will still be responsible for paying the relevant tax due. Many states have an inheritance tax that must be paid in addition to the federal estate tax but not Texas. An inheritance tax is a state tax placed on assets inherited from a deceased person.

Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. Federal estate tax return. How much can you inherit without paying taxes in Texas.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Inheritance and Estate Taxes. Federal estatetrust income tax return.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. You can give a gift of up to 15000 to a person without having to pay a federal gift tax. Understanding how Texas estate tax laws apply to your particular situation is critical.

On the one hand Texas does not have an inheritance tax. Maryland and New Jersey have both. Final federal and state income tax returns.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Texas ended its state inheritance tax return for all persons dying on or after january 1st 2005. Someone will likely have to file some taxes on your behalf after your death though including the following.

Maryland is the only state to impose both. Learn five different ways for texans to read breaking news. However if a loved one gifts you something elsewhere in the country you may need to pay that states inheritance tax.

Before 1995 Texas collected a separate inheritance tax called a pick-up tax The tax did not increase the total amount of estate tax paid upon death. The inheritance tax is paid by the person who inherits the assets and rates vary depending on the quantity of the inheritance and the inheritors relationship with the deceased. You may have to pay federal estate taxes but not state inheritance taxes.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. There is a 40 percent federal tax however on estates over 534 million in value. Fortunately Texas is one of the 33 states that does not have an inheritance tax.

March 1 2011 by Rania Combs T he short answer to the question is no. In 2015 Texas removed its inheritance tax. Twelve states and Washington DC.

Texas does not have a state estate tax or inheritance tax. Many states have an inheritance tax that must be paid in addition to the federal estate tax but not Texas. Since there are two of them the estate tax.

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Inheritance Laws What You Should Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

State And Local Tax Deductions Data Map American History Timeline Usa Map

What Is Estate Planning Basics Checklist For Costs Tools Probates Taxes Estate Planning Estate Planning Attorney Estate Tax

State Corporate Income Tax Rates And Brackets Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem New Homeowner Real Estate Estate Tax

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Retirement Income Retirement Locations

What Is Property Tax Collection Lawsuits In Texas In Law Suite What Is Property Property Tax

Texas Inheritance Laws What You Should Know Smartasset

Texas Inheritance Laws What You Should Know Inheritance Law Community Property

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax

Things To Avoid While Purchasing A Home

Texas Estate Tax Everything You Need To Know Smartasset

Tax Savings Is Just One Of The Many Benefits Of Homeownership These Are Some Of The Items That Can Be Home Ownership Real Estate Tips Estate Tax